How Security Deposits Work in Jurny

Security deposits protect your properties against damages—but how they’re handled depends on the tools you use. Jurny supports multiple approaches, each with different fee structures, limitations, and guest experiences.

Quick Navigation Index

To easily navigate through this guide, click on any of the sections below to jump directly to the information you need:

Why Security Deposit Matters

How you collect and release security deposits impacts:

-

Processing fees

-

Guest experience

-

Cash flow

-

Risk exposure

-

Dispute and refund handling

Choosing the wrong setup can result in unnecessary fees, guest frustration, or limited protection—especially for longer stays.

Overview: 3 Ways to Handle Security Deposits

In Jurny, security deposits can be handled in three main ways:

-

Charge the deposit

-

Pre-authorize (hold) the deposit

-

Replace the deposit with damage protection insurance

Each option has different implications for fees, guest experience, and operational flow.

Option 1: Charge a Security Deposit

How It Works

-

The deposit amount is charged to the guest’s payment method

-

Funds are collected upfront

-

The amount is later refunded if no damages occur

Key Characteristics

-

Funds are immediately available

-

Refunds must be processed manually or automatically based on your setup

-

Processing fees apply to the charge (and refund, depending on your payment provider)

Best Used When

-

You want full control over funds

-

You are comfortable managing refunds

-

Pre-authorization is not required

Option 2: Pre-Authorize a Security Deposit

Pre-authorization places a temporary hold on the guest’s card without charging them.

In Jurny, pre-authorization can be handled in two ways.

Pre-Authorization via Jurny + Stripe

How It Works

-

Jurny places a pre-authorization hold on the guest’s credit card through Stripe

-

The hold duration is governed by Stripe rules

Stripe Hold Limits

-

Standard / blended Stripe accounts: up to 7 days

-

IC+ Stripe accounts: up to 30 days

(Typically granted to accounts processing ~$1M+ annually)

What to Consider

-

This setup works well for short stays

-

For longer stays, the hold may expire before checkout

-

Stripe rules apply regardless of the PMS used

Pre-Authorization via Autohost + Stripe

How It Works

-

The same Stripe pre-authorization rules apply

-

Autohost automatically renews the hold every 7 days

-

The deposit remains active for the entire stay

What to Consider

-

Each renewal may include an additional Autohost fee

-

Depending on the guest’s bank:

-

Holds and releases may overlap

-

Temporary higher held amounts may appear

-

-

This is a technical workaround for Stripe’s hold limits, not a Stripe exception

Important:

The logic of pre-authorization is the same in both cases—Autohost adds automation for longer stays.

Option 3: Damage Protection Insurance

How It Works

-

The guest pays a one-time, non-refundable fee

-

No security deposit is held or charged

-

Coverage applies according to the insurance policy

Key Characteristics

-

No blocked funds on the guest’s card

-

No deposit refunds to manage

-

Often preferred by guests

-

Can be offered as an alternative to a traditional deposit

Providers such as RentalGuardian are commonly used for this option.

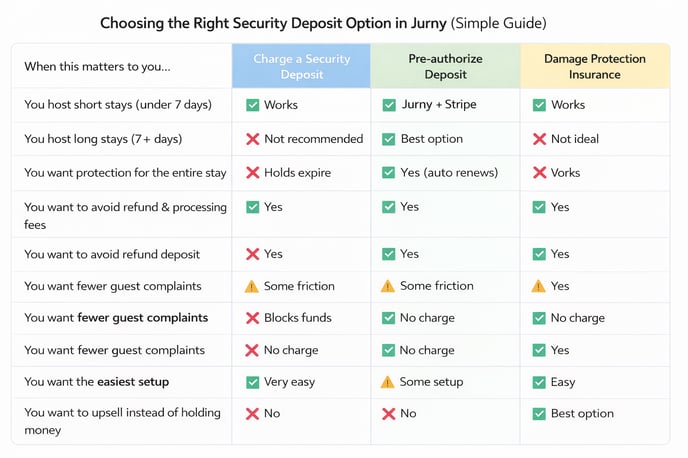

Comparison Table

Choosing the Right Option

There is no single “best” setup. The right choice depends on:

-

Average length of stay

-

Guest profile

-

Fee sensitivity

-

Risk tolerance

-

Operational preferences

Many operators combine approaches—for example:

-

Pre-authorization for short stays

-

Insurance for long stays

-

Charged deposits for specific properties

If you need help or have any questions, don’t hesitate to reach out.

Contact your Customer Success Manager or our support team at support.jurny.com – we’re happy to assist.